COVERING THE BASICS

Our services are available to investors across the Oklahoma City Metro. Oklahoma City offers low purchase prices, landlord friendly tenant laws, and competitive rent rates.

Are you wholesalers?

We occasionally wholesale deals.

Are you property managers?

Yes, we offer in house property management! Learn more here.

How do you share deals with your investors?

New properties are emailed to all of our investors and posted to our website every Wednesday. Good deals don’t last long, the best deals are spoken for within minutes release.

Save our email (hello@table.investments) and respond quickly to secure deals you’re interested in!

Do you offer tours of Oklahoma City?

We are happy to host you at our office so you can meet the team. We provide you with a self-guided tour so you can explore Oklahoma City on at your pace.

If I find a home I’d like to purchase can you help me?

We’re happy to! We can analyze the deal, negotiate the terms, contract the property for you, and manage it.

How long do I have to hold an investment?

You can sell any time you want. Unless you’re forcing appreciation by adding value we recommend planning to hold the property for at least 4 years.

Are there requirements investors must meet to work with you?

We work with investors at all levels. No financial minimum is required. When purchasing a property, you must have the approval of a lender or, if you’re paying cash, proof of funds.

PRE-SCREENED PROPERTIES

Prenegotiated Prices

Prices are prenegotiated. You don’t have to worry about properties going into multiple offers or determining a fair price. We do the legwork for you!

All you have to do is review the documentation from our screening and negotiate any repairs you’d like.

Inspections

All inspections are performed by third party inspectors and made available to our investors. Inspections are paid for by the buyer at closing.

Repair Estimates

We secure an estimate from a contractor or handyman for any deficiencies found during the home inspections. This allows our investors to negotiate repairs before executing a contract or paying a deposit.

Property Documentation

Each of these items are secured during the screening process.

Management Documentation

We request copies of these during the screening process.

BUYING PROCESS

Your goals aren't one size fits all, neither are our investments.

We offer pre-screened properties across a spectrum of property types, equity positions, and locations.

Flexibility allows us to pivot when the market does and offer the best deals in any market.

- Step 1. Consultation

- Step 2. Financing + Fees

- Step 3. Selection

- Step 3. Purchase

- Step 4. Development

- Step 5. Management

There are a million ways to invest. Timeline, budget and location all impact strategy. We believe the best way to get to your goal is to start with the end in mind.

Our process starts with a phone consultation to discuss your goals, our screening/buying process and all things Oklahoma City. After the consult you’ll start receiving properties each Wednesday.

Financing can make or break your deal.

Before you get serious about finding a deal you’ll want to meet with a lender and develop a financial plan. We’re happy to provide referrals.

Our team does not require a deposit to get started with us. When you decide to purchase a property, an earnest-money down payment is required. Additional money is due at the closing. While closing costs can vary from deal to deal, these are the typical amounts we see on residential properties.

INSPECTIONS

$700

TITLE

$1,000

LENDING

$2,100

DOWNPAYMENT

20% – 25% (of purchase price)

Move quick, they're first come, first serve.

- Properties are released to our newsletter subscribers and on our website every Wednesday.

- To claim a property simply respond to the email or reach out to your investment specialist.

- You review the documentation compiled during our pre-screening process.

- We confirm your financing plans are in order.

- We share a purchase contract with you to e-sign. The contract outlines the purchase price, closing date, financing terms, and the repairs you’d like the seller to pay for.

You secured the deal. Here's what happens next:

- We present your contract to the seller and negotiate repairs. We help you negotiate with the seller. any repairs or credits with the seller.

- When both parties sign, the contract is considered executed,

- The earnest money deposit is due at the time the contract is signed.

- Our team begins working with the lender, appraiser, insurance, and title company.

- When all parties have finished their work we schedule closing.

- Local investors sign final paperwork with a title company. Out of state investors sign final paperwork with a mobile notary.

You're an investor, not a project manager.

We specialize in selling stable rental properties, so most properties we offer do not require a rehab. If you have a distressed property that you need help stabilizing we can manage the entire project, including selecting the team, preparing the scope of work, outlining the schedule, and paying contractors.

Our project management services are exclusively available to property management clients.

Our in house management is stellar.

Property management has been done the same archaic way for decades. It’s time for a refresh. We leverage technology to provide full transparency and reliable follow through for our owners.

EXPECTED ROI

Assumptions are guides, not guarantees.

Our assumptions around ROI are based on our recommendation that all owners have property insurance (most lenders require it). Taxes and insurance premiums are based on the taxable value of the property. The value is assessed annually and is impacted by sales price, mortgages, permits, etc. Lastly, we encourage investors to budget a portion of gross rent for maintenance. Maintenance norms are impacted by the age of the property, age of mechanicals, and overall condition.

APPRECIATION

3%

TAXES

1%

INSURANCE

1%

VACANCY

5%

MAINTENANCE

3% - 10%

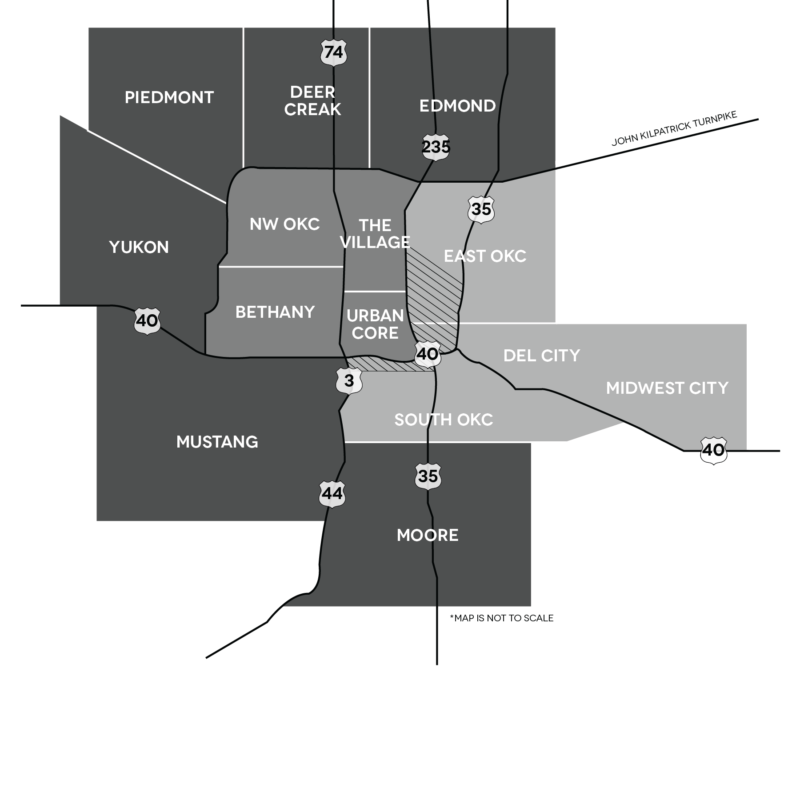

A CLASS

Overview

Average Cap Rate: 5.0% – 6.0%

Average Price Point: $125,000+

Edmond

About: Large suburb liked for schools, low vacancy, and growth

Type: Single family, new construction, condo, townhome

Pricing: $125,000+ (condo/townhome) $200,000+ (single family)

Deer Creek

About: Large suburb liked for schools, appreciation, and growth

Type: Single family, new construction

Pricing: $200,000+ (single family)

Piedmont

About: Small suburb liked for proximity to central OKC and affordability

Type: Single family, new construction

Pricing: $175,000+ (single family)

Yukon

About: Medium suburb liked for schools and proximity to central OKC

Type: Single family, new construction

Pricing: $150,000+ (single family)

Mustang

About: Small suburb liked for schools and proximity to central OKC

Type: Single family, new construction

Pricing: $165,000+ (single family)

Moore

About: Large suburb liked for schools, convenience, and affordability

Type: Single family

Pricing: $125,000+ (single family)

B CLASS

Overview

These properties are our “bread and butter.” There’s no flash, no real opportunity to increase value and no opportunity to force appreciation. They are consistent though, and deliver consistent results.

Average Cap Rate: 5.0% – 7.2%

Average Price Point: $90,000 – $150,000

Bethany

About: Just west of the Urban Core, liked for affordability

Type: Single family

Pricing: $90,000+ (single family)

Northwest Oklahoma City

About: Just north of the Urban Core, liked for location and growth

Type: Single family, duplex

Pricing: $125,000+ (single family)

The Village / Urban Core

About: Historic and mid-century areas liked for rapid growth, appreciation, and convenience

Type: Single family, multi-family

Pricing: $100,000+ (single family), $250,000+ (multi-family)

C CLASS

Overview

These properties can offer high yields on paper, but can be tricky to achieve that performance. To ensure these yields are actually achieved, we encourage our investors to do more due diligence and confirm the condition.

Average Cap Rate: 7.0% +

Average Price Point: $90,000 –

East Oklahoma City

About: Historic area liked for affordability and potential appreciation

Type: Single family, multi-family

Pricing: $50,000+ (single family), $90,000+ (multi-family)

Del City / Midwest City

About: Liked for affordability, growth, and proximity to Tinker Air Force Base (local investors invest heavily here)

Type: Single family

Pricing: $90,000+ (single family)

Note: Del City requires an occupancy test each time there is a new occupant residing in the property.

South Oklahoma City

About: Liked for affordability and moderate growth (local investors invest heavily here)

Type: Single family

Pricing: $65,000+ (single family)

I’m an investor. I have a LLC in the States and have purchased 2 properties in Detroit.

Looking to expand my portforlio

Do you have a full team available?

thanks,

Wendy brandstatt

Hey there Wendy! We’ve got a few clients who are in Detroit. From what we’ve hear there’s definitely money to be made but you’ve got to be diligent since it can be a challenging market. How was your experience?

And yep, we do have a team here in OKC. Can you tell us a bit about what you’re looking for? Are you looking for a team to help you with buying properties? Or management?

PS- feel free to email us at hello@table.investments if you want to schedule a call to chat about what you need.